TL;DR

Banking is bookkeeping, bookkeeping is accounting. For decades, banks have been connected to each other, delivering immeasurable economic benefits with secure, reliable transaction processing at global scale. The accounting software industry has the opportunity to deliver the same or greater benefits to society by following suit. Just as interconnectivity created new revenue opportunities for banks, so interconnectivity can create new revenue opportunities for accounting platforms.

Introduction

The business of managing debits and credits is known as bookkeeping, the foundation of all accounting.

Stripped to the barest of essentials, banking is bookkeeping: moving debits and credits to represent deposits or loans, payments or withdrawals, interest and fees.

Sometimes transactions occur between accounts within a single bank, sometimes between accounts at different banks.

Recognizing this need to communicate with each other, banks and payment service businesses created an infrastructure ecosystem to transfer messages between each other securely, efficiently, across national boundaries, and able to handle immense amounts of traffic.

Connectable but not connected

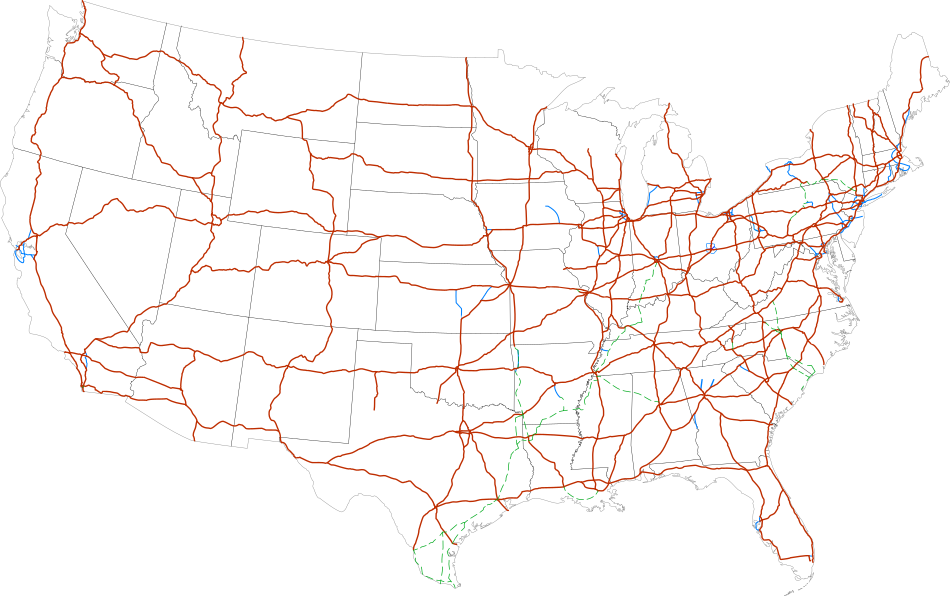

Looking at the diagram below, we can see that as a result, banks are very well connected to each other.

Depending on jurisdiction and the type of transaction, banking peers may choose from messaging networks such as SWIFT, or CHA or a card scheme to move transaction messages between themselves.

Banks make themselves connectable to third party non-banks by offering APIs under the Open Banking initiative.

Contrast the situation with accounting platforms. Accounting platforms are every bit as connectable as banks. Most, although not all, accounting platforms offer third parties the chance to integrate with them, either at the application or the data level.

However, when it comes to peer connectivity between accounting platforms, it’s clear they don’t have the same degree of systematic connectedness enjoyed by banks.

Whereas banks are both connectable by outsiders and connected to each other, accounting platforms are connectable, but not connected.

This is the problem which Bmbix solves.

The role of Bmbix

Bmbix was created to provide to accounting platforms the same degress of connectedness as banks have enjoyed for decades.

By creating the infrastructure to allow all accounting systems everywhere to be connected, we will have provided accounting software providers with a platform upon which new services and revenues can be built.

More importantly, our reading of demographic trends tells us that a new generation of business software users are going to expect accounting to provide as seamless and convenient an experience as digital banking. 1

Whilst various solutions have existed from the earliest days of EDI for point-to-point links between large industries, or networks dedicated to particular sectors, our approach is to integrate at the level of the accounting platform provider.

We have studied the technical structure and economics of the different banking messaging systems. We then reworked and adapted the best features of each, to create a solution optimised for general purpose accounting.

As a result, Bmbix has evolved into a system able to deliver secure real-time messaging to all accounting systems.

Summary

Banking and accounting have enough in common that it is reasonable to look for successful technology solutions from the one to see if they might be useful to the other.

Working from the insight that the core activity of banking is bookkeeping, and that what works for bank bookkeeping should also work for more general accounting we started a programme to examine bank messaging systems, from both an economic and technical perspective.

This led to the second insight that not all connectivity choices are the same: that being connectable is not the same as being connected.

Changing user expectations will put irresistable pressure on accounting platform providers to become connected.

We believe that the parallels with the banking sector show that if accounting platforms choose a connected future it could be a win for them, their clients and wider society.